- CONTACT INFORMATION

-

For inquiries about available incentives and project qualification, contact:

Drew Brassfield

Assistant Director of Planning - 806-378-5241

- [email protected]

NEZ Incentive Program Details

The Neighborhood Empowerment Zone program is designed to improve neighborhood conditions by encouraging private investment in housing, businesses, and services in the neighborhood plan areas. Authorized by Chapter 378 of the Texas Local Government Code, the NEZ program makes incentives such as building permit fee waivers, sales tax rebates, and municipal property tax abatements available to homeowners, investor-owners, and developers proposing new construction or rehabilitation in designated zones.

How Does It Work?

- Identify your construction or rehabilitation project. See the sample case studies for examples and review the eligibility list in the helpful links section. Projects must meet the goals of the respective neighborhood plans, and the Development Guidelines established for each zone.

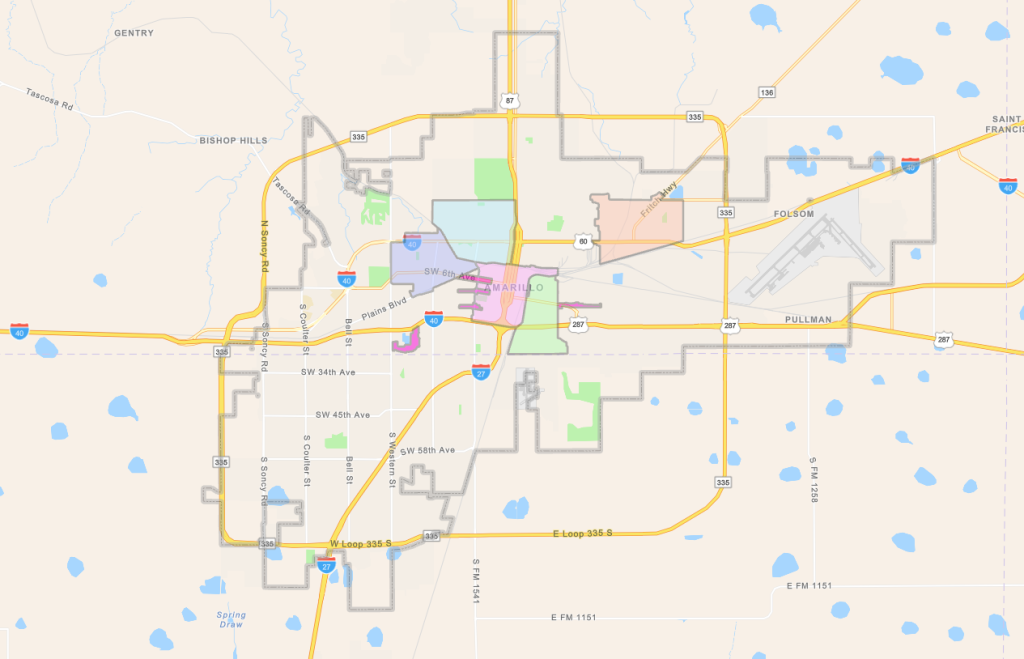

- Verify that the project is located within one of five Neighborhood Empowerment Zones. Note, in Downtown, the program is limited to fee waivers for residential projects. Use the map to check the address location.

- Complete the application and submit to the Assistant Director of Planning, Drew Brassfield.

- Planning staff will then review complete applications to ensure the project meets the requirements of the program. Approved projects will receive NEZ Certification. This immediately qualifies the project for development fee waivers and the other departments will be notified. If applying for permit fee waivers only, you will not pay anything at the time of permitting.

- Projects that invest 20% or more of the PRAD Improvements Value are then eligible to receive a property tax abatement on the increase in value or a sales tax rebate. Both of these incentives are required to be approved by City Council which will require an additional 4-6 weeks.

Where are the Neighborhood Empowerment Zones located?

- North Heights

- Barrio

- San Jacinto

- Eastridge

- Downtown* (residential only, fee waivers only)

- Commercial Corridors

Neighborhood empowerment zone incentive program document links

Neighborhood Empowerment Zone FAQs

What incentives are available through the NEZ program?

There are three types of incentives available:

- Development Fee Waivers

- Municipal Property Tax Abatement* (5 or 10-year agreements)

- Sales Tax Rebates* (.5%, 5-year agreements)

*Projects are required to invest at least 20% of the PRAD Improvements Value.

What types of projects are eligible for NEZ incentives?

- Owner-Occupied Single-Family: Includes rehabilitation or new construction for single-family homes.

- Investor-Owned Single-Family: Includes rehabilitation or new construction for single-family homes.

- Multi-Lot Single-Family: New construction projects for owner-occupied single-family homes.

- Duplex, Townhome, and Condominium: Rehabilitation or new construction for properties that are owner or renter-occupied.

- Multi-Family Apartments: Rehabilitation or new construction for apartment buildings with 3 or more units.

- Mixed-Use Projects: Rehabilitation or new construction for projects combining residential and commercial uses.

- Non-Residential Projects: Rehabilitation or new construction for neighborhood services, retail, office, institutional, and light commercial uses, adhering to development guidelines and neighborhood plans.

- Note: Tax rebates may be available through a Chapter 380 agreement.

Is there a fee to apply for the NEZ program?

There is no fee to apply for the Neighborhood Empowerment Zone Incentive Program.

If my property is within an Empowerment Zone, am I required to participate?

You are not required to participate. If you are applying for permits for the project, you’ll be asked to sign an acknowledgment that you are aware of the program and choose not to apply.

Who can I contact for questions regarding Neighborhood Empowerment Zones?

Assistant Director of Planning, Drew Brassfield 806-378-5241 or [email protected]